Federal 30 % Solar Investment Tax Credit (ITC)

he ITC allows you to subtract 30 % of your total system cost—equipment, labor, permitting, and battery storage—from the federal tax you owe. On a typical $18,000 rooftop array, that’s a $5,400 dollar-for-dollar credit.

Key points

| Details | |

|---|---|

| Applies to | PV panels, micro-inverters, racking, batteries ≥ 3 kWh, electrical upgrades |

| Claim it with | IRS Form 5695, then transfer the credit to line 5 of Schedule 3, Form 1040 |

| Carry-forward | Unused credit rolls forward up to 5 years |

| Expires | Scheduled to step down in 2033 (26 %) and 2034 (22 %) unless Congress renews |

🔗 Internal link: “Full 2025 ITC Walk-Through”

Eligibility Checklist

Requirement |

Federal ITC | Net Metering |

|---|---|---|

| Own the system (cash/loan) | ✅ | ✅ |

| Placed in service in tax year claimed | ✅ | n/a |

| Own home / landlord consent | ✅ | ✅ |

| System ≤ 5 MW AC | n/a | ✅ |

| Interconnection approval | n/a | ✅ |

Leased systems & PPAs do not qualify for the ITC but may still participate in net metering—clarify this to pre-qualify leads.

.

Maine-Specific Solar Incentives & Programs

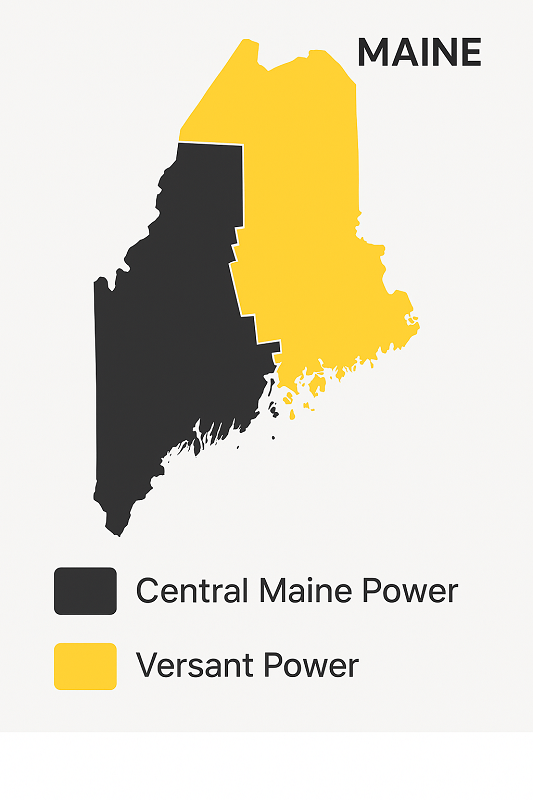

3.1 Net Energy Billing (NEB)

Maine’s NEB policy lets you bank kWh credits at the full retail rate. Credits roll forward for 12 months; unused credits expire annually, so sizing your system correctly is key.

Example: A 6 kW array producing 7,500 kWh/year offsets roughly $1,650 at CMP’s current 22¢/kWh residential rate.

3.2 Community Solar

If your roof is shaded or you rent, you can subscribe to an off-site solar farm. You still receive bill credits, but the federal ITC stays with the project developer. Community solar reduces bills 10-15 % without upfront cost—great content for renters.

3.3 Efficiency Maine Rebates

-

Solar Thermal: Up to $500 for qualifying domestic hot-water systems.

-

Heat-pump & weatherization bundles sometimes stack with solar installs—link to Efficiency Maine rebate portal.

Pro tip: Mention that PV installations often qualify for no-sales-tax status on equipment under Maine’s renewable-energy exemption.

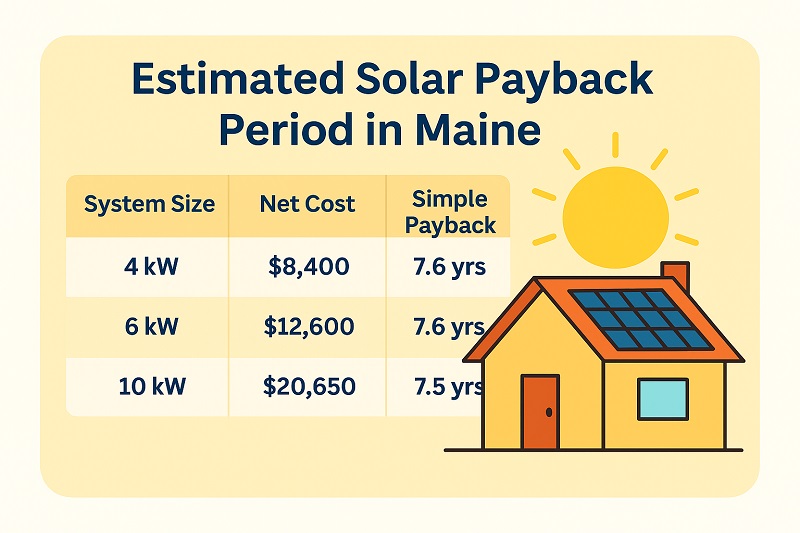

Cost & Payback Snapshot

| System Size | Gross Cost* | Federal ITC | Net Cost | Yr-1 Bill Savings** | Simple Payback |

|---|---|---|---|---|---|

| 4 kW | $12,000 | –$3,600 | $8,400 | $1,100 | 7.6 yrs |

| 6 kW | $18,000 | –$5,400 | $12,600 | $1,650 | 7.6 yrs |

| 10 kW | $29,500 | –$8,850 | $20,650 | $2,750 | 7.5 yrs |

* Statewide avg. installed price ≈ $2.95/W (SolarReviews Q1 2025)

** Based on CMP residential rate 22 ¢/kWh, 1 % annual utility-rate escalation

Include a disclaimer: “Actual costs vary by installer, equipment, and roof complexity.”

Local Installer Spotlight

Feature 2–3 reputable installers (affiliate or directory partners) with bullet credentials:

-

ReVision Energy — 4.9 ★ Google rating, 18 yrs experience

-

SunDog Solar — specializes in battery backups

-

Maine Solar Solutions — offers 25-year workmanship warranty

Include zip-code quote widget to capture leads.

Key Resources & External Links

-

Efficiency Maine Solar — application forms & program rules

-

CMP Net Energy Billing Manual

-

DSIRE USA Maine Incentives Database

-

IRS Form 5695 Instructions